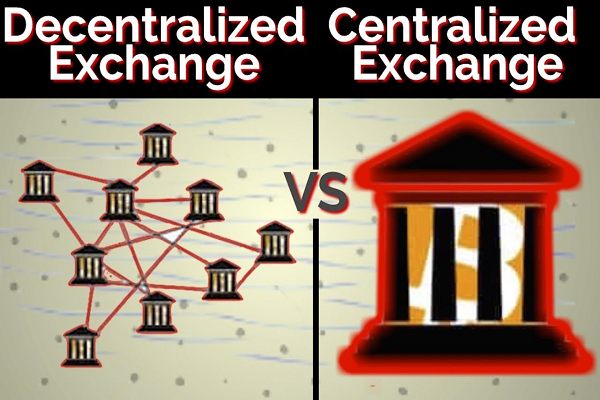

To exchange digital currencies, each client requires a cryptocurrency transaction. Yet, did you realize two kinds of digital money trades one is being a concentrated crypto trade while the other is a decentralized cryptocurrency trade?

Difference Between Centralized & Decentralized Exchanges

Be that as it may, before we profound plunge into what a unified and decentralized crypto trade is allowed we first to get what is a digital money trade? A cryptocurrency exchange is only where one can trade digital currencies, just like CoinDCX. Each cryptocurrency trade has its own standards and guidelines to be adhered to with the sole plan to give its clients admittance to cryptocurrencies.

WHAT IS A CENTRALIZED CRYPTOCURRENCY EXCHANGE

A platform where you can trade computerized resources like cryptographic money. In these sorts of trades, an outsider is utilized to screen and get the exchanges for the client. The blockchain system doesn’t follow these arrangements.

The concentrated cryptographic money trades require their clients to confirm their own data prior to utilizing the devices given by them. In the event that the client is an association, it should give some corporate data to the course of the check.

The confirmed clients on these trades get to partake in a higher withdrawal quantity alongside other client assistance if there should be an occurrence of any specialized mistake. The concentrated cryptocurrency trades are very famous among crypto aficionados since they offer level sets at stable costs.

These are not difficult to involve and follow all the consistence for a got and simple crypto excursion of their clients. Probably the most well-known unified digital money trades are Binance, Coinbase, and so on CoinDCX, India’s most straightforward and most secure digital currency trade is additionally a concentrated trade.

WHAT IS A DECENTRALIZED CRYPTOCURRENCY EXCHANGE?

A decentralized crypto trade (DEX) is basically the same as an incorporated crypto trade however without outsider mediation, these trades don’t depend on any outsider. The assets in the trade are put away on the blockchain.

Peer-to-peer trading (P2P) is likewise permitted by these trades that require the utilization of an escrow framework or intermediary tokens. This is not the same as the IOU framework utilized by incorporated cryptographic money trades. AirSwap and Barterdex are instances of decentralized digital currency trades.

SECURITY

Although centralized trades have exceptionally severe security methodology decentralized crypto trades offer more assurance. Brought together trades are for the most part undermined by programmers.

The previous encounters of hacking with incorporated trades have prompted numerous security redesigns by them. On account of a decentralized trade, there is no danger implied with losing one’s asset because of such demonstrations.

Decentralized exchanges are safer than their concentrated partners since there is no chance of numerous misfortunes of assets because of a solitary reason.

POPULARITY

Without a doubt brought together crypto trades are more well-known than DEXs on the grounds that they were the ones to enter the market first. Centralized exchanges have greater liquidity and a better framework to follow.

Be that as it may, with time more decentralized crypto exchanges are entering the market which will significantly affect their prevalence.